Retail Investors lap up to Harsha Engineers Ltd IPO, Overall Issue Subscribed 2.87 times on Day 1

Retail Investors lap up to Harsha Engineers Ltd IPO, Overall Issue Subscribed 2.87 times on Day 1

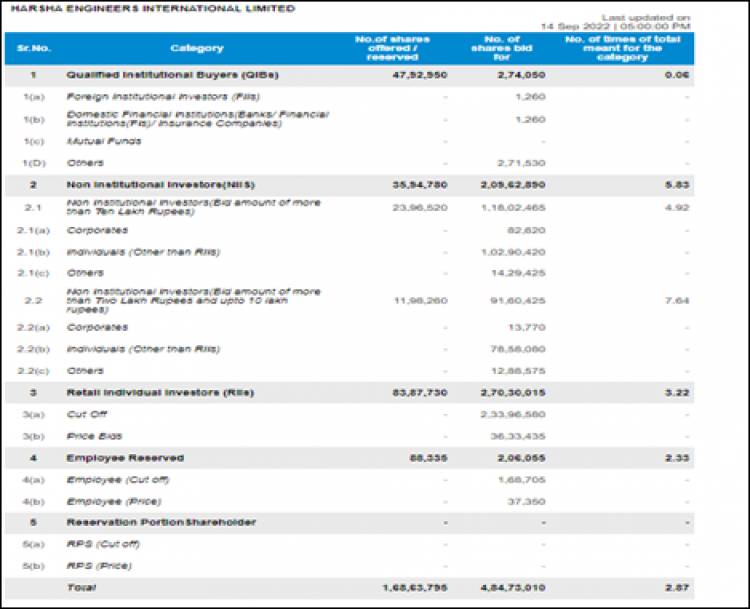

Chennai, September 14, 2022: The Initial Public Offering (IPO) of Harsha Engineers, the largest manufacturer of precision bearing cages, in terms of revenue, in organised sector in India, and among the leading manufacturers of precision bearing cages in the world, received bids of 4,84,73,010 shares against the offered 1,68,63,795 equity shares, at a price band of ₹314-330, according to the data available on the stock exchanges. Overall the issue was subscribed 2.87 times on the first day of bidding.

Retail Investors saw a robust demand and was subscribed 3.22 times. The qualified institutional buyer portion was subscribed 0.06 times. The reserved portion of non-institutional investors witnessed a subscription of 5.83 times. The issue kicked off for subscription on Wednesday, September 14, and will be open till Friday, September 16.

The offer consists of a fresh issue of equity shares aggregating to Rs 455 crore, and an offer for sale of up to Rs 300 crore by existing shareholders.

Ahead of its issue opening, Harsha Engineers International Limited raised Rs 225.7 crore from marquee investors such as American Funds Insurance Series Global Small Capitalization Fund, Goldman Sachs Funds - Goldman Sachs India Equity Portfolio, PineBridge Global Funds - PineBridge India Equity Fund, Abu Dhabi Investment Authority-Monsoon are among the investors that participated in the anchor book. In addition, shares have been allocated to domestic funds Whiteoak Capital, HDFC Mutual Fund, SBI Mutual Fund, Franklin Templeton India MF, UTI MF, SBI Life, Nippon India Mutual Fund, ICICI Prudential Mutual Fund, DSP Mutual Fund, ICICI Prudential Life Insurance & L&T Investment Management are among the investors that participated in the anchor book. The company aims to raise Rs 755 crore through its IPO.

Motilal Oswal Financial Services, ICICI Securities, Anand Rathi, LKP Securities, BP Equities, Hem Securities, Investmentz, Arihant Capital and others have given recommendations of a Subscribe rating to the issue.

Axis Capital Limited, Equirus Capital Private Limited, and JM Financial Limited are the book-running lead managers to the issue, and Link Intime India Private Limited is the registrar of the offer. The equity shares are proposed to be listed on BSE and NSE.

Company Information

Harsha Group was established in the year, 1986 by founder, and promoters Harish Rangwala and Rajendra Shah, both having more than 35 years of experience in the precision engineering and bearings cages manufacturing sector that primarily operates in the automotive, railways, aviation & aerospace, construction, mining, agriculture, electrical and electronics, renewable energy, and other industrial sectors.

The Company offers a wide range of bearing cages starting from 20 mm to 2,000 mm in diameter. It has approximately 50-60% of the market share in the organised segment of the Indian bearing cages market and 6.5% of the market share in the global organised bearing cages market for brass, steel and polyamide cages in CY 2020. It also manufactures complex and specialised precision stamped components, welded assemblies, brass castings, cages & bronze castings, and bushings.

The Ahmedabad-based company offers a diversified suite of precision engineering products across geographies and end-user industries, which comprises of engineering business, under which it manufactures bearing cages (in brass, steel, and polyamide materials), complex and specialised precision stamped components, welded assemblies, brass castings and cages & bronze bushings; and solar EPC business, under which it provides complete comprehensive turnkey solutions to all solar photovoltaic requirements.

As of March 31, 2022, has manufactured more than 7,205 bearing cages and more than 295 other products. In addition, over the past three years, its product development and innovation centre has developed more than 1,200 products in different bearing types.

The company has five strategically located manufacturing facilities with two of its principal manufacturing facilities at Changodar and one at Moraiya, near Ahmedabad in Gujarat in India, and one manufacturing unit each at Changshu, China, and Ghimbav Brasov in Romania, which helps it to penetrate global markets more efficiently and in a cost-effective manner and allow access to its customers in over 25 countries covering five continents i.e., North America, Europe, Asia, South America, and Africa.

Harsha Engineers’ revenue from operations increased by 51.24% to Rs 1321.48 crore for fiscal 2022 from Rs 873.75 crore for fiscal 2021, primarily due to increase in its revenue from operations from the engineering business, while profit after tax has increased by 102.35% to Rs 91.94 crore for fiscal 2022 from Rs 45.44 crore for fiscal 2021, primarily due to increase in the revenue from operations from the engineering business and reduction in the operating loss of solar EPC business as well as gain on account of exchange rates.